Reinforce subscriber commitment and lifetime value with an AI-driven, proactive churn-prevention strategy that anticipates and circumvents failed payments and cancellations.

PaymentKis is the centralized platform for more efficient subscription management that fuels revenue. The combined power of AI and machine learning helps SaaS businesses design automated campaigns customized to simplify retention and optimize workflows.

Get up and running in no time. Set up a fully branded experience in a few, quick steps.

Attach your logo, select brand colors, customize your email style, add your signature, and you're good to go.

Harness the power of AI for an intelligent and results-driven workflow.

Ensure your dunning, cancellation, cross-sell, upsell, and win-back flows deliver better LTV

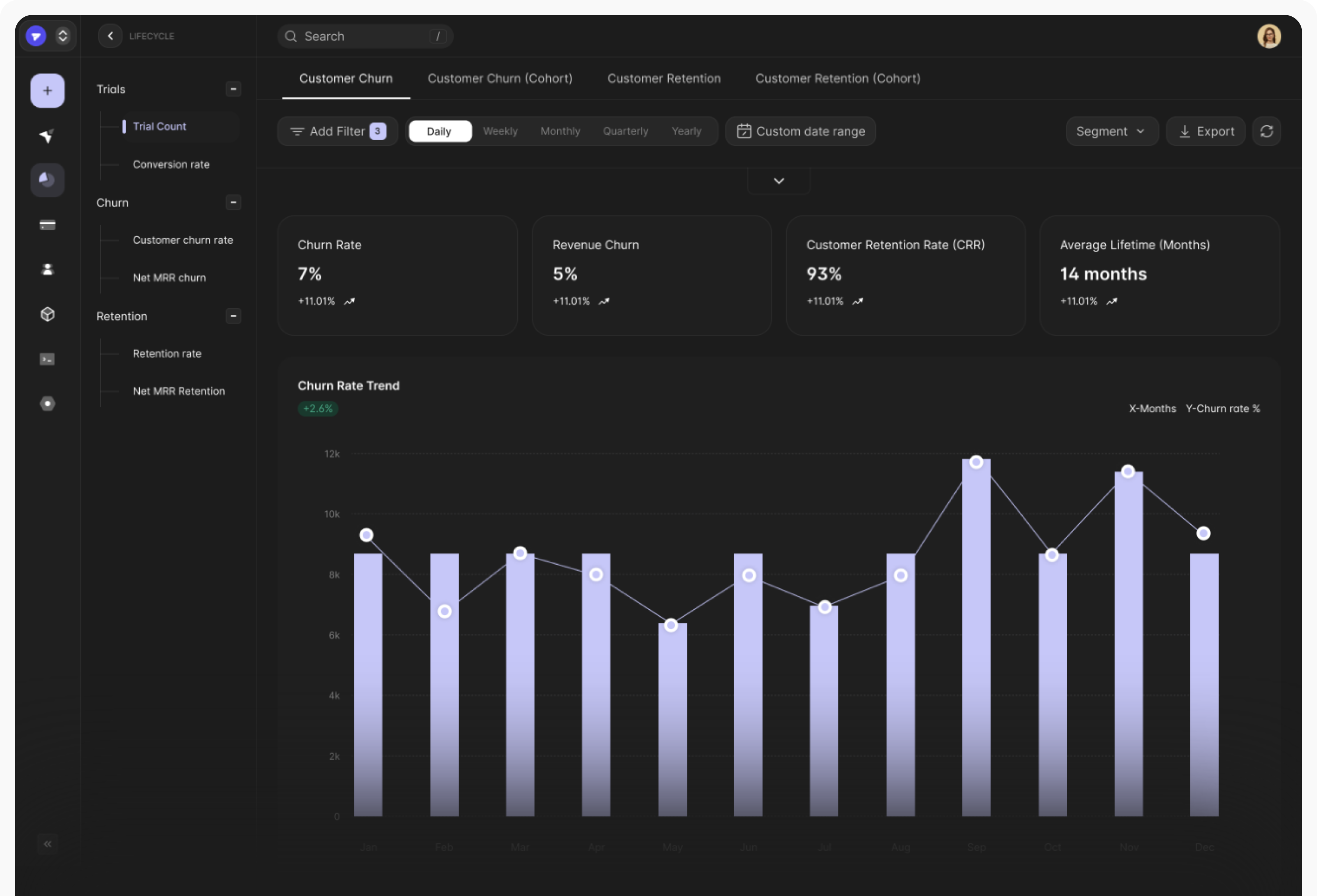

In the fast-paced SaaS environment, minimizing churn is a demanding task, and it's crucial to preserving and boosting revenue.

Let PaymentKit keep your churn in check and prevent it from eroding your revenue.

Reduce customer drop-off with smarter retention tools.

Total Users On Our Platform

Transaction Success Rate

Annual Transaction Volume

Rating From Real Customers

Capture more sales with fewer interruptions at checkout.

Take advanced action with a customized dunning flow that helps you secure revenue.

Make it easy for customers to update payment details and avoid billing issues with targeted, personal emails that guide them through the process.

Turn everyday touchpoints into long-term loyalty.

Target satisfied and highly engaged customers primed for tailored upsells and cross-sells to grow LTV.

Leverage in-depth insights to deliver attractive offers that align with what they truly value alongside their subscriptions.

Gain actionable insights from any cancellations

Learn why customers cancel (via exit surveys, save offers, A/B testing retention strategies), and turn misses into opportunities to gather feedback and improve services.

Utilize PaymentKit to entice customers into completing checkout, and increase conversion rates with perfectly timed and personalized email triggers for abandoned carts.

After switching to PaymentKit, we noticed an immediate improvement in our global transactions. It helps us oversee our entire product portfolio from a single dashboard, while delivering fast and seamless payments for users.

Austin W.

Director of Product, Adly

You have questions? We have answers!

Contact Us we will happy to help you

© 2025 PaymentKit, Inc. All rights reserved