Avoid problems that cost you money. Drive higher revenue with intelligent routing and recovery, and see rapid growth with centralized AI analytics.

We identify the best processor for each payment, based on which ones have the highest success rate and lowest transaction fees.

[1]

More routing options facilitate more efficient and cost-effective payment processing. You’re not limited to a single processor.

[2]

Enjoy seamless support for payments worldwide

[3]

Our platform easily integrates with major payment processing tools to level-up your business. No service disruptions, we promise.

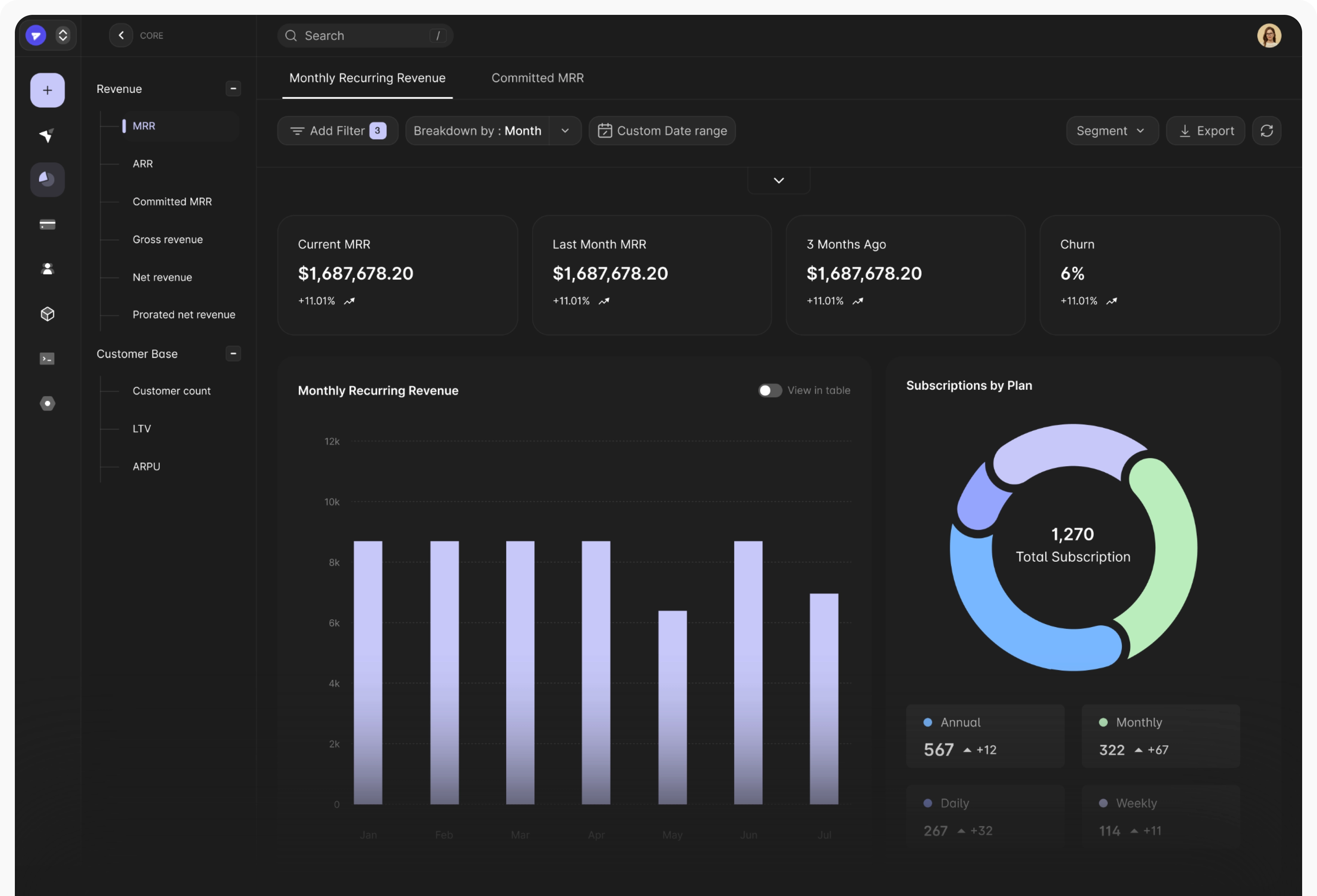

A single place to navigate data-driven analytics and visualize customer insights to inform business decisions.

[1]

Real-time notifications on major changes in key metrics let you take timely action

[2]

Live monitoring of Monthly and Yearly Recurring Revenue (MRR/ARR), Customer Lifetime Value (LTV), and churn rate

[3]

Cohort analysis helps identify and interpret patterns in customer behaviors and lifecycles

Get ahead of preventable losses from payment failures and card processing errors, and keep your customer base and revenue secure.

[1]

AI-powered forecasting based on behavioral data anticipates and counteracts churn and cancellations

[2]

Intuitive payment retries recapture failed payments and automated follow-ups facilitate sales recovery

[3]

Exclusive, personalized deals drive customer retention

After switching to PaymentKit, we noticed an immediate improvement in our global transactions. It helps us oversee our entire product portfolio from a single dashboard, while delivering fast and seamless payments for users.

Austin W.

Director of Product, Adly

More efficient subscription management and payment processing means lower costs and higher revenues with PaymentKit

Our platform is designed to work with your existing toolsets and systems

Level-up from your current platform by switching to PaymentKit and a wide variety of payment options.

Enjoy less work combined with greater efficiency with unified access to all the tools you need on a single platform.

Drive stronger revenue flow with smart solutions to payment routing and recovery and AI-powered customer insights.

Managing multiple tools makes processes unnecessarily complicated, instead of efficient. Simplify payments with PaymentKit — it’s a win-win for both your business and customers.

You have questions? We have answers!

Contact Us we will happy to help you

© 2025 PaymentKit, Inc. All rights reserved